The beginning of 2020 was looking strong for B2B companies — until March 15th. That’s when we saw major changes in B2B advertising.

Last week, our CEO Todd Krizelman hosted a webinar to give an insider’s look into the current state of B2B advertising.

“We know we can’t look at event spend exhibits and sponsorship at events,” explained Todd. “We actually took out the magazine piece too because so much of what was placed in the print side of B2B trade journals was placed before the pandemic.”

Without the ability to measure those two channels, digital has become the litmus test of what’s going on in B2B advertising.

Some of the most interesting changes we’ve seen were the B2B verticals that initially shot up. Now that things are getting into a new rhythm, we’re seeing those same verticals ease back into their normal investment levels.

We encourage you to subscribe to our Blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

B2B verticals with short-lived spikes

We know that the B2B sector is wide and diverse. Each vertical is doing its own thing, so here we share which verticals saw an ephemeral spike after the initial hit of COVID-19.

1. Home Furnishing

Home furnishing companies advertised heavily on B2B websites in the early days of the pandemic. Compared to January and February, spending in Mid-March spiked by 85%.

People needed to set up their home offices as they transitioned to remote work. However, once the buying spree concluded spending quickly returned to normal levels.

2. IT

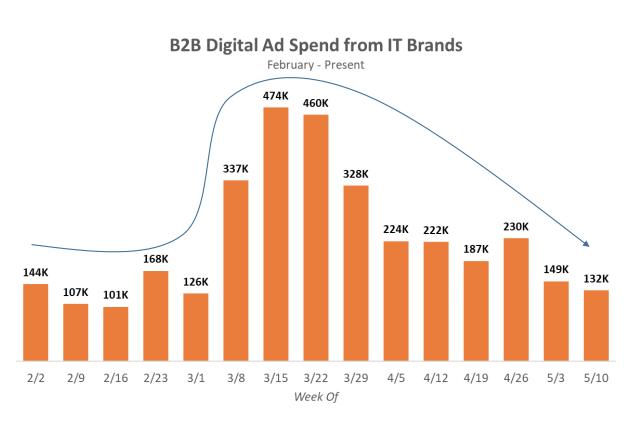

As companies scrambled to move their workforces out of the offices, IT companies poured money into their digital ads. There was a massive spike — IT companies were spending almost half a million dollars a week on digital advertising to get in front of their audiences.

The messaging was consistent across brands: “We’ll help your team go from working in an office to working remotely.”

However, once companies adjusted to the new normal, spending returned to levels comparable to pre-pandemic levels.

3. Business School and Masters Programs

As economic uncertainty took hold, business school ad spend was up 43% MoM in March and Executive Education programs were up 64% MoM (specifically across B2B media).

With massive layoffs and stay-at-home orders, it’s likely that many people had piqued interest in continued education. Graduate programs were quick to promote their offerings.

Since the initial surge, spending has returned to normal levels. Over the past 4 weeks ad spend from this category was within 5% of where it was in February.

These slices of the B2B pie have returned to their normal sizes, but other pieces are ramping up their spend and others are making cuts. While different B2B verticals are going every direction like they did early on in the crisis, the total digital investment from B2B companies has remained consistently higher than last year.

For more insights on the current state of digital B2B advertising, listen to the full webinar.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.